With the increasing popularity of “Buy Now, Pay Later” (BNPL) services, consumers now have more choices than ever for managing their purchases. Two of the most popular BNPL options are Sezzle and Afterpay. Both platforms allow customers to make purchases and pay them off over time, but each has unique features that may make one more suitable for your needs than the other. This article will provide a comprehensive comparison of Sezzle vs Afterpay, examining how they work, their fees, ease of use, customer service, risks, credit requirements, and more to help you decide which service might be the better choice for you.

Sezzle vs Afterpay: An Overview

Before diving into the detailed comparison, let’s take a quick look at what Sezzle and Afterpay are and how they operate in the BNPL landscape.

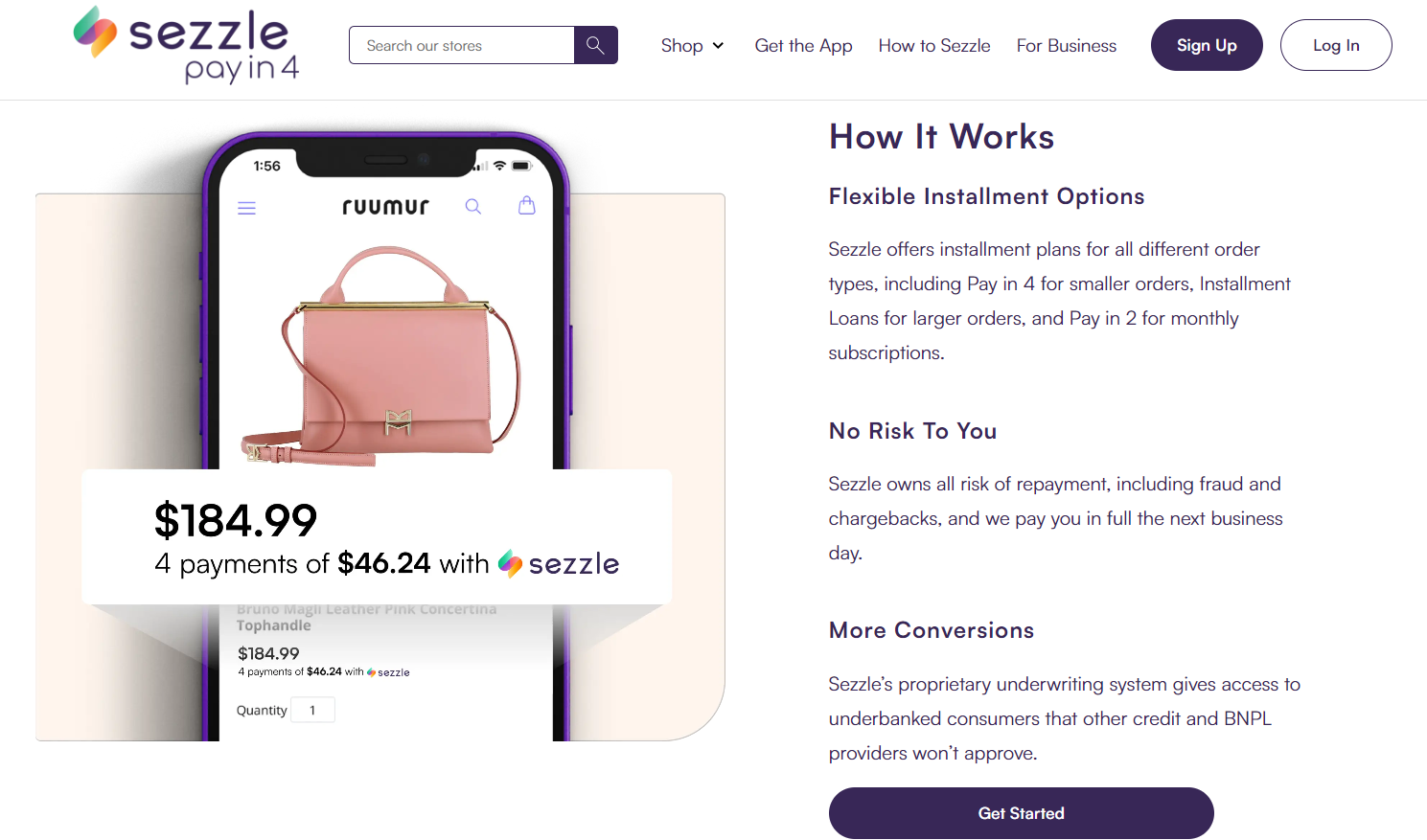

What Is Sezzle?

Sezzle is a BNPL service that was founded in 2016 in the United States. It allows customers to split their purchases into four interest-free payments, typically due every two weeks. Sezzle aims to offer a flexible payment solution that helps customers manage their spending without incurring high-interest rates or fees. One unique feature of Sezzle is its focus on financial education and building better credit habits among its users. With Sezzle Up, users can also build their credit score by making on-time payments.

What Is Afterpay?

Afterpay, founded in Australia in 2014, is another leading BNPL service that has gained popularity across multiple countries, including the United States, the United Kingdom, Canada, and New Zealand. Like Sezzle, Afterpay allows users to divide their purchases into four interest-free payments, which are usually due every two weeks. Afterpay is well-known for its straightforward user experience and has a large network of participating retailers, making it a convenient option for many shoppers.

Sezzle vs Afterpay: How They Work?

Both Sezzle and Afterpay operate on a similar premise: allowing users to purchase now and pay later in installments. However, the nuances of how these two platforms work can vary slightly.

Sezzle users create an account and link it to a payment method (bank account, debit, or credit card). When making a purchase, the first payment is typically due immediately, with the remaining three payments scheduled over the next six weeks. Sezzle performs a soft credit check when users sign up, which does not impact their credit score. It also provides the option to reschedule one payment for free, with any further changes incurring a small fee.

Afterpay also requires users to set up an account and link a payment method. Similar to Sezzle, the first payment is made at the time of purchase, followed by three subsequent bi-weekly payments. However, Afterpay does not perform any credit checks, making it accessible to a broader range of users. If a payment fails, Afterpay charges a late fee and may restrict the user from making further purchases until their account is in good standing.

Sezzle vs Afterpay: A Detailed Comparison

Pricing & Fees

Sezzle and Afterpay both offer interest-free payments, but their fee structures differ slightly.

- Sezzle: While Sezzle does not charge interest, it does impose fees in certain situations. For example, if a payment fails, Sezzle charges a fee of up to $10. Additionally, if a user needs to reschedule more than one payment, a $5 fee is applied for each additional change. Sezzle also offers a premium version, Sezzle Premium, which provides users with extra benefits like higher spending limits and more flexibility in managing payments, but this service comes with a subscription fee.

- Afterpay: Afterpay also charges no interest on its installment plans. However, it has a different fee structure. If a user misses a payment, Afterpay charges a late fee of up to $10, and if the payment remains unpaid for a certain period, an additional fee may be applied, with a cap depending on the total order value. Afterpay does not have any subscription fees or premium versions.

Verdict: Both Sezzle and Afterpay offer interest-free payments, but Afterpay may have lower fees for missed payments, depending on the purchase amount. Sezzle, however, allows more flexibility with payment rescheduling, which could be a deciding factor for those who need more control over their payment schedules.

Ease of Use

Ease of use is a crucial factor when choosing a BNPL service, as a seamless user experience can enhance the overall shopping experience.

- Sezzle: Sezzle’s platform is user-friendly, with a straightforward interface that makes managing payments and rescheduling options easy. The app is available on both iOS and Android and integrates smoothly with a range of online retailers. Sezzle also provides users with notifications and reminders to help them stay on top of their payments.

- Afterpay: Afterpay is also known for its user-friendly interface. Its app, available on both iOS and Android, allows users to browse stores, manage payments, and receive notifications. Afterpay integrates with numerous retailers, both online and in-store, making it highly convenient for users who prefer a variety of shopping options.

Verdict: Both Sezzle and Afterpay score high in ease of use, with intuitive apps and helpful payment management features. However, Afterpay might have a slight edge due to its broader network of partner retailers, offering more shopping flexibility.

Integration with Retailers and Platforms

Integration with retailers is key to the usability of BNPL services like Sezzle and Afterpay, providing users with shopping flexibility.

- Sezzle: Primarily focuses on online shopping with numerous partners in the U.S. and Canada, making it ideal for online shoppers. It integrates well with eCommerce platforms like Shopify, WooCommerce, Magento, Wix, and BigCommerce, etc. but offers limited in-store options, which could be a drawback for those preferring physical stores.

- Afterpay: Supports both online and in-store purchases and has a broad network of retailers across the U.S., Australia, the UK, Canada, and New Zealand. It allows easy in-store use via a barcode in the app and integrates well with platforms like Shopify and Magento, providing greater versatility.

Verdict: Afterpay is more versatile with its extensive network of both online and in-store retailers across multiple countries, making it a better choice for users seeking more shopping flexibility. Sezzle is best for those focused on online shopping, with fewer options for in-store use.

Customer Service

Quality customer service is essential for resolving issues promptly and ensuring a positive user experience.

- Sezzle: Sezzle offers customer support via email and a comprehensive help center on its website. Users generally report positive experiences with Sezzle’s customer service, although response times may vary.

- Afterpay: Afterpay provides customer support through email, phone, and its help center. It also offers a live chat feature, which can be advantageous for users needing immediate assistance. Afterpay’s customer service is known for being responsive and effective.

Verdict: Afterpay provides more options for customer support, including a live chat feature, which could offer faster resolution times. Sezzle, while generally reliable, may not be as accessible for users needing quick help.

Risks

Both Sezzle and Afterpay come with certain risks, especially for users who may struggle with managing payments or face financial difficulties.

- Sezzle: Sezzle users risk incurring fees for missed payments or frequent rescheduling. Additionally, while Sezzle’s credit checks are soft and won’t impact credit scores, missing payments can still affect a user’s financial standing. Sezzle also reports payment behavior to credit bureaus if users sign up for Sezzle Up, which can help build credit or, conversely, harm it if payments are missed.

- Afterpay: Afterpay does not conduct credit checks, which is advantageous for those with lower credit scores. However, the risk of accumulating late fees is present if payments are not managed properly. Afterpay can also temporarily suspend user accounts for missed payments, limiting purchasing options until payments are caught up.

Verdict: Both platforms carry risks associated with missed payments, but Afterpay’s lack of credit checks might be less intimidating for users with lower credit scores or who are wary of credit checks. Sezzle’s reporting to credit bureaus could be a double-edged sword—beneficial for building credit, but risky if payments are missed.

Credit Requirements

Credit requirements can determine whether a user qualifies for a BNPL service.

- Sezzle: Sezzle conducts a soft credit check when users sign up, which does not impact credit scores. This process is mainly to assess the user’s ability to manage payments responsibly. Users with lower credit scores can still qualify, but spending limits may be lower initially.

- Afterpay: Afterpay does not perform any credit checks, making it accessible to a broader range of users, including those with poor or no credit history. However, Afterpay may impose tighter spending limits or require upfront payments for certain users.

Verdict: Afterpay is more inclusive regarding credit requirements, as it does not perform any checks. Sezzle may be a better choice for those looking to improve their credit score over time, thanks to its optional credit reporting feature.

Sezzle vs Afterpay: When to Use?

Choosing between Sezzle and Afterpay often depends on the specific circumstances and financial goals of the user. Here are some scenarios to help you decide when to use each service:

When to Use Sezzle:

- Building Credit: If you’re looking to build or improve your credit score, Sezzle might be the better option. With Sezzle Up, you can have your payment history reported to credit bureaus. This can be advantageous for establishing a positive credit history, provided you make all payments on time.

- Payment Flexibility: Sezzle allows users to reschedule one payment for free, which is beneficial if you anticipate needing a little extra time to manage your payments. If you’re someone who values flexibility in managing your finances, Sezzle’s rescheduling option might be more suitable.

- Managing Smaller, Frequent Purchases: If you often make smaller purchases and prefer having a little extra flexibility with payment options and schedules, Sezzle’s approach might be more accommodating. It also suits users who prefer a simple, straightforward payment plan with the option to adjust as needed.

When to Use Afterpay:

- Shopping Across Multiple Retailers: Afterpay has a more extensive network of participating retailers, both online and in-store, across various countries. If you frequently shop from different retailers or travel internationally, Afterpay’s broader reach might be more convenient.

- No Credit Check Requirement: Afterpay does not perform a credit check when you sign up, making it a good choice for those who may have a lower credit score or who want to avoid any form of credit inquiry. This makes it accessible to a wider range of consumers, including those new to credit or those who want to avoid the impact of hard inquiries on their credit reports.

- Simpler, Fixed Payment Plans: Afterpay’s structure is relatively straightforward with automatic payments every two weeks. If you prefer a fixed payment schedule without any need for rescheduling or extra management, Afterpay might be more straightforward and easier to use.

Verdict: Use Sezzle if you want more flexibility with payments or are interested in building your credit score. Opt for Afterpay if you prefer a service without a credit check, need access to a wide range of retailers, or want a more straightforward payment plan without rescheduling options. Ultimately, the choice depends on your financial needs and how you plan to use the service.

Conclusion

In conclusion, both Sezzle and Afterpay offer convenient BNPL services with distinct features that cater to different needs. Afterpay might be the better option for those looking for a broader range of retailers and simpler eligibility requirements, especially for those with lower credit scores. Sezzle, on the other hand, offers more flexibility in managing payments and the potential to build credit with Sezzle Up, making it a good choice for those focused on financial growth. Ultimately, the choice between Sezzle and Afterpay will depend on your personal financial situation, shopping habits, and credit goals.

Afterpay vs Sezzle: FAQs

1. What happens if I never repay Sezzle or Afterpay?

If you never repay Sezzle or Afterpay, your account may be frozen, preventing you from making further purchases. Additionally, both platforms may report unpaid debts to collections agencies, which could negatively impact your credit score. Sezzle, especially if you’re enrolled in Sezzle Up, will report missed payments to credit bureaus, further affecting your credit standing.

2. Are Sezzle and Afterpay legit?

Yes, both Sezzle and Afterpay are legitimate BNPL services that operate within the financial regulations of the countries where they are available. They have established partnerships with numerous retailers and have millions of active users. However, like any financial service, users should be aware of the terms and conditions, fees, and potential risks involved.

3. What is the difference between Sezzle and Sezzle Up?

Sezzle is the standard BNPL service allowing users to split payments into four installments. Sezzle Up is an optional feature that allows users to build their credit scores by reporting on-time payments to credit bureaus. To use Sezzle Up, users must link a bank account and maintain a positive payment history.

4. Can I pay off my Sezzle and Afterpay purchases early?

Yes, both Sezzle and Afterpay allow users to pay off their balances early without any penalties. This flexibility can be advantageous for users looking to manage their finances proactively or avoid potential late fees.

5. Does Sezzle Up show up on your credit report?

Yes, if you opt into Sezzle Up, your payment history will be reported to credit bureaus. This can help build your credit score if you make timely payments but could also negatively impact your credit if you miss payments.