In the dynamic world of eCommerce, Shopify Capital has emerged as a game-changer for entrepreneurs seeking to fuel their growth without traditional financing hurdles. This innovative service offers merchants access to vital funds based on their sales performance, allowing them to scale their businesses with ease.

This article delves into the intricacies of Shopify Capital, exploring its features, benefits, and potential drawbacks. Whether you’re a seasoned Shopify user or newbie, this comprehensive guide will help you understand how Shopify Capital can support your business aspirations and drive your online store’s success.

What is Shopify Capital?

Shopify Capital is a financing service provided by Shopify, designed to help merchants obtain the funds they need to grow their businesses. Unlike traditional loans, Shopify Capital offers cash advances based on a merchant’s sales performance. Repayments are made through a percentage of daily sales, making it a flexible option for business owners.

This service aims to simplify the funding process, enabling entrepreneurs to invest in inventory, marketing, and other growth initiatives without the lengthy approval processes and stringent requirements typical of conventional financing methods. Shopify Capital is tailored specifically for eCommerce businesses on the Shopify platform.

How Does Shopify Capital Work?

Shopify Capital operates by providing eligible merchants with cash advances or short-term loans to support their business growth. The process begins with Shopify assessing a merchant’s sales history and overall performance on the platform to determine eligibility. If approved, the merchant receives an offer detailing the amount of funding available and the repayment terms.

For cash advances, merchants receive a lump sum upfront and repay it through a fixed percentage of their daily sales until the total amount, plus a fee, is repaid. For short-term loans, merchants repay through regular installments over a specified period.

The flexibility of repayment is a key feature, as it adjusts with the merchant’s sales volume—higher sales mean faster repayment, while lower sales extend the repayment period. This model ensures that repayments are manageable and aligned with the business’s revenue flow, providing a seamless and supportive financing solution.

Pros and Cons of Using Shopify Capital

Pros of Using Shopify Capital

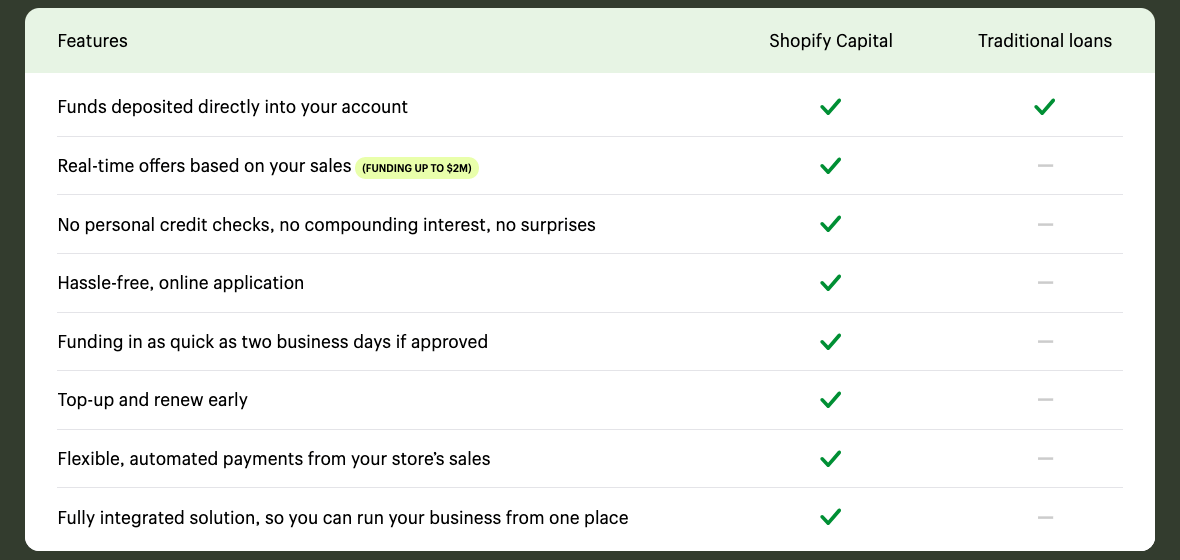

- Quick and easy access to funds: Shopify Capital simplifies the application process, allowing eligible merchants to access funds quickly, bypassing the usual complexities of traditional loans.

- Flexible repayment terms: Repayments are tied to a percentage of daily sales, making it easier for merchants to manage cash flow. This flexibility ensures that repayment amounts adjust according to sales performance.

- Not affected by credit score: Shopify Capital prioritizes a merchant’s sales history over their credit score, broadening accessibility to a wider array of businesses.

- Tailored for Shopify merchants: As a service integrated with the Shopify platform, it provides a seamless experience for users, with funding and repayment processes designed specifically for eCommerce needs.

- No Upfront Costs or Hidden Fees: Shopify Capital is transparent about the costs associated with its financing options. There are no upfront fees or hidden charges, making it easier for merchants to understand exactly what they are committing to financially. This transparency helps merchants plan their finances more effectively without worrying about unexpected costs.

Cons of using Shopify Capital

- Higher costs: The fees linked with Shopify Capital might surpass those of traditional loans, potentially elevating the overall borrowing expenses.

- Repayment tied to sales: While flexible, this repayment method means that a significant portion of daily sales revenue goes toward repayment, which might impact cash flow for other business expenses.

- Eligibility limitations: Not all Shopify merchants qualify for Shopify Capital. Eligibility is based on sales performance and other factors, which may exclude newer or smaller businesses.

- Limited to Shopify platform: This financing option is only available to merchants using Shopify, restricting access for those who operate on other eCommerce platforms.

- Potential for Increased Debt Dependency: Relying on advances like those offered by Shopify Capital can lead some businesses to become dependent on external financing for growth rather

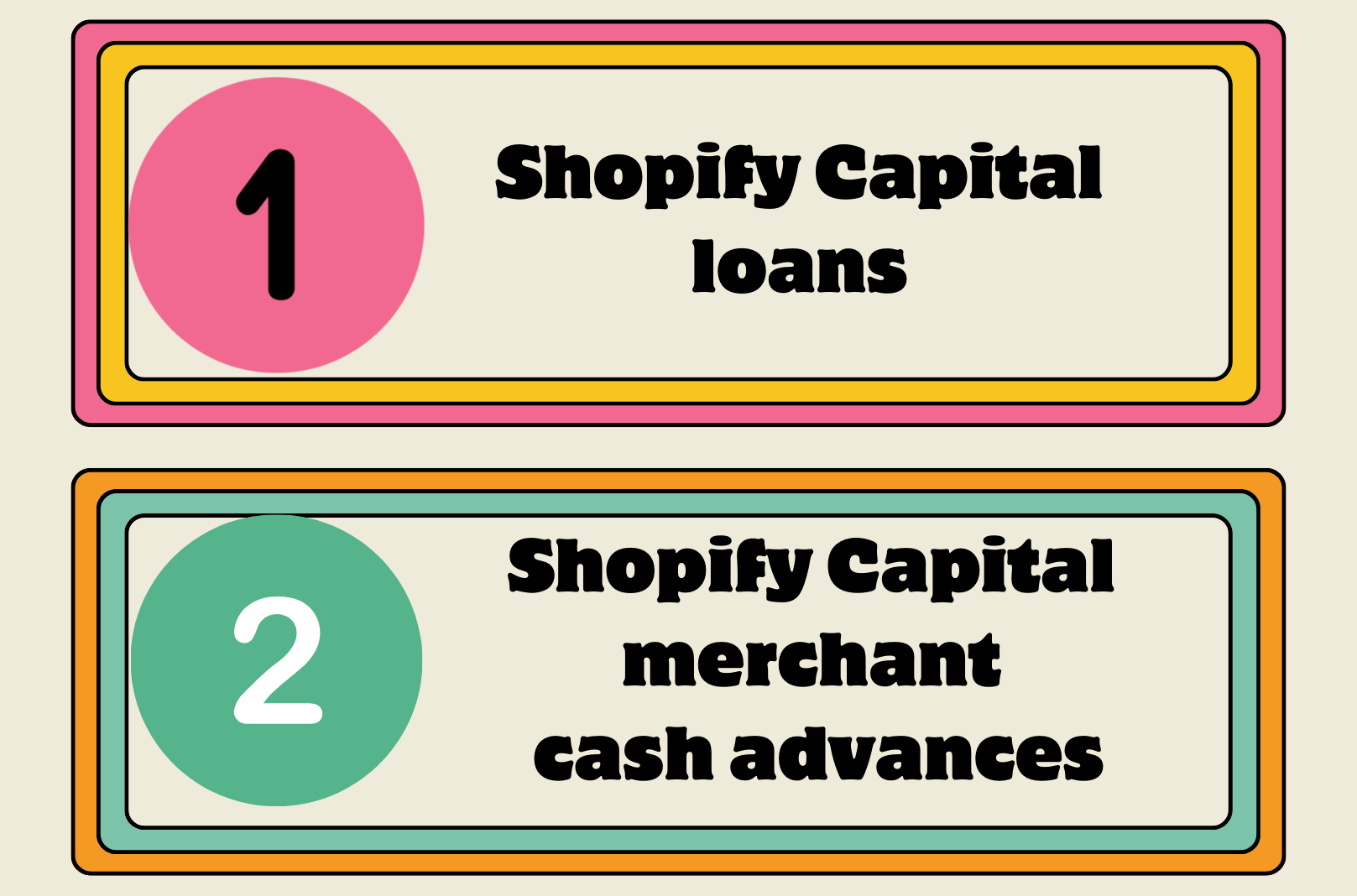

Two Funding Forms of Shopify Capital

Shopify Capital offers two primary forms of financing that cater to different business needs and cash flow structures. These options provide flexibility and accessibility, ensuring that merchants can choose the form of funding that best suits their operational strategies and financial situations.

Here’s a closer look at each type:

1. Shopify Capital loans

Shopify Capital loans are a form of short-term financing where eligible merchants receive a lump sum of money that they repay through fixed, regular installments over a specified period. The loan amount, repayment schedule, and fees are clearly outlined in the offer provided by Shopify Capital. Implementing reliable top loan servicing software can help lenders maintain accuracy in payment tracking and compliance monitoring.

This option enables merchants to anticipate repayment amounts, simplifying budgeting and cash flow management. The fixed installment structure can be beneficial for businesses that prefer consistent repayment amounts rather than variable payments tied to sales performance.

2. Shopify Capital merchant cash advances

Shopify Capital merchant cash advances provide merchants with an upfront lump sum in exchange for a percentage of their future daily sales until the advance and a fee are repaid. This form of financing is highly flexible, as the repayment amount adjusts with the business’s sales volume. On days with higher sales, more is repaid, and on days with lower sales, less is repaid.

This dynamic repayment model aligns closely with the merchant’s revenue, offering a manageable and adaptable way to access funds without the pressure of fixed installment payments. However, it can also mean that during slower sales periods, the repayment extends longer than initially anticipated.

What can you use Shopify Capital funds for?

Shopify Capital provides financing that can be leveraged for a wide range of business needs, supporting entrepreneurs as they scale and evolve. This flexibility is crucial for merchants who need to adapt to changing market conditions and seize growth opportunities. Below, we explore how these funds can be effectively utilized in different areas of a business:

1. Human Resources

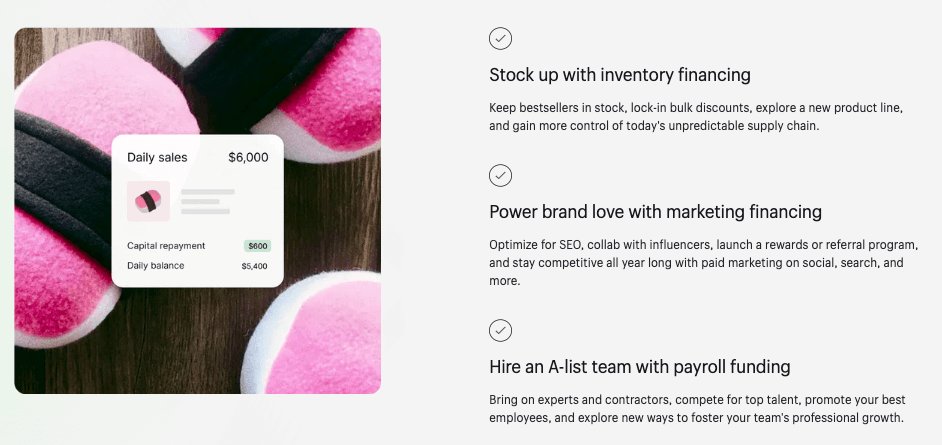

One of the most significant investments any growing business can make is in its team. Shopify Capital can be used to hire new employees, offer training for existing staff, or expand payroll to attract top talent. Investing in human resources not only enhances the operational capabilities of a business but also fosters a more dynamic and innovative workplace environment.

2. Inventory

For retail and eCommerce businesses, having the right inventory is critical to meeting customer demand and driving sales. Shopify Capital allows merchants to bulk buy inventory, which can lead to cost savings and better profit margins. Additionally, funds can be used to diversify product lines or invest in higher-quality items, which can differentiate a store from its competitors and appeal to a broader customer base.

3. Marketing

Effective marketing drives visibility and attracts customers, both of which are essential for business growth. Shopify Capital can fund various marketing initiatives, from digital advertising campaigns and social media promotions to more traditional forms of marketing like print ads or event sponsorships. By boosting their marketing budget, businesses can increase their reach, enhance brand recognition, and drive more sales.

4. Redesign Your Store

Whether it’s a physical storefront or an online shop, the design and layout can significantly impact customer experience and sales performance. Shopify Capital can be used to refurbish a physical store or overhaul a website’s design. Improving aesthetics, functionality, and the overall shopping experience can attract more customers and potentially increase average order values.

Shopify Capital provides the financial flexibility needed for businesses to make strategic decisions and investments without the immediate pressure of traditional loan structures. Whether it’s expanding the team, stocking up on inventory, ramping up marketing efforts, or revamping a store, Shopify Capital is designed to support businesses at various stages of their growth journey.

Shopify Capital Requirements and How To Apply

Shopify Capital is fairly accessible. Shopify reaches out to eligible small businesses with an offer letter and application details, though businesses must qualify first.

What’s available for who?

Availability of Shopify Capital varies by location and the type of financing offered:

- Australia: Shopify loans are available.

- Canada: Cash advances are offered.

- United Kingdom: Cash advances are available.

- United States: Both cash advances and, in certain states, cash loans are accessible.

Shopify Capital eligibility requirements

Shopify Capital has only a few requirements for applicants:

- Use Shopify Payments or another accepted third-party payment provider.

- Meet Shopify’s sales volume criteria. Consistent sales without significant revenue drops enhance your repayment capability and increase your eligibility.

- Maintain a low-risk business profile.

- Have a reasonable purpose for the capital use, which can positively influence your application. While you have flexibility in spending, a specific plan for the funds can improve your chances of approval.

However, Shopify does not publicly disclose the exact sales volume needed or the detailed criteria for a low-risk business profile.

How to apply for Shopify Capital?

Shopify will notify you via email about your funding eligibility. Once notified, you can begin the application process. Here’s how to apply:

- In your Shopify admin, go to Settings and select Capital.

- Click View funding offer.

- Review the three available funding offers from Shopify. Choose one option by carefully comparing them, then click Request under your preferred term.

- The Review Loan Terms and Submit Application dialog box will appear. Read the terms and conditions thoroughly, then click Accept terms to proceed. Each financing option typically includes the following terms: Amount received, Total debt, and the Repayment fee deducted from daily revenue.

After completing these steps, your application process is done. Now, wait for Shopify’s approval.

How to Repay the Remaining Shopify Capital Balance?

1. Pay back Shopify Capital loan

To repay your Shopify Capital loan, follow these steps:

- Step 1: In your Shopify admin, go to Settings and select Capital.

- Step 2: In the Capital section, select Payment.

- Step 3: Enter the amount you wish to repay. You can pay off the entire balance or a custom amount.

- Step 4: Click Next Step to confirm the repayment amount.

- Step 5: Select Payment to complete the process.

Once your repayment is processed, a confirmation email will be sent to you.

2. Pay back Shopify merchant cash advance

To remit a Shopify merchant cash advance, follow these steps:

- Step 1: From your Shopify admin, go to Settings and click on Capital.

- Step 2: Click on Remit balance.

- Step 3: Review the amount to be remitted. To remit the entire balance, check the authorization box and click Remit balance.

Shopify Capital – FAQs:

What is Shopify Capital?

Shopify Capital stands as a dedicated financing service offered by Shopify to eligible merchants. It serves the purpose of providing accessible funds aimed at supporting and facilitating business growth initiatives.

Do you have to pay back Shopify Capital?

Yes, merchants who opt for funding through Shopify Capital are obligated to repay the borrowed amount. This repayment includes any associated fees or interest, all of which are outlined in the agreed-upon terms and conditions.

Where is Shopify Capital balance?

Merchants can conveniently check their Shopify Capital balance directly within their Shopify admin dashboard. Navigate to the Capital section under Settings to access detailed information regarding your current balance and repayment status.

What bank does Shopify Capital use?

Shopify Capital operates independently of traditional banks. Instead of utilizing external banking institutions, Shopify directly provides financing to merchants through its own funding mechanisms. This approach allows Shopify to tailor financing solutions based on merchants’ sales performance and specific business needs, ensuring a more personalized and accessible financial support system.

Final thoughts

In conclusion, Shopify Capital offers a convenient and flexible financing solution tailored for Shopify merchants. With its straightforward application process, adaptable repayment terms, and accessibility based on sales performance rather than credit scores, it stands out as a viable option for eCommerce businesses seeking growth funding.

However, potential users should weigh the costs and eligibility requirements carefully. Overall, Shopify Capital serves as a potent instrument for entrepreneurs to expand their businesses and attain their financial goals.