As a Shopify merchant, navigating the complexities of sales tax can be daunting. Sales tax rules and regulations can differ greatly based on your location, customers’ locations, the products you offer, and the volume of your sales.

This detailed guide will walk you through everything you need to know about Shopify sales tax, including how it functions, how to set up tax collection, and how to generate essential tax reports. Whether new to eCommerce or a seasoned seller, this ultimate guide to Shopify sales tax will provide you with the knowledge needed to stay compliant and prevent costly errors.

Shopify Sales Tax: An Overview

Sales tax is a government-imposed tax on the purchase of goods and services. In the U.S., sales tax is typically charged at the state level, although local municipalities may impose additional taxes. As a Shopify merchant, you must know your obligations to collect and remit sales tax based on your and your customer’s location.

Shopify simplifies the sales tax process by allowing you to configure your tax settings based on various factors, such as location and product type. However, it’s crucial to understand that Shopify does not automatically handle all aspects of sales tax compliance. As the merchant, you are responsible for ensuring that your tax setup aligns with the laws and regulations applicable to your business.

How Does Sales Tax Work on Shopify?

Shopify provides tools to help you automate sales tax collection, but understanding how it works is essential. When a customer purchases, Shopify calculates the appropriate sales tax based on the customer’s location and the tax settings you have configured in your store. This amount is then added to the total cost of the order at checkout.

To set up sales tax on Shopify, you need to:

- Determine Nexus: a legal concept that defines a connection between a business and a state. If your company has a nexus in a state, you must collect sales tax there. Nexus can be created by a physical presence, like a store or warehouse, or by economic presence, such as exceeding a specific sales or transaction threshold within the state.

- Set Up Tax Settings: Once you’ve determined where you have nexus, you can set up your tax settings in Shopify to collect the correct sales tax amount. Shopify allows you to configure tax rates for each location where you have nexus.

- Remit Sales Tax: After collecting sales tax from customers, you are responsible for remitting it to the appropriate tax authority. This process usually involves filing a tax return and paying the state or local government.

Should I Charge Sales Tax on Shopify?

Whether or not you need to charge sales tax on Shopify depends on several factors, including your location, where your customers are located, the type of products or services you sell, and the volume of your sales. Let’s break down the critical considerations regarding whether or not you should be charging sales taxes.

Types of Sales Taxes

Sales taxes can be broadly categorized into state sales taxes, local sales taxes, and use taxes:

- State Sales Tax: This is the most common type of sales tax imposed by individual states. The rate can vary significantly from one state to another, with some states imposing no sales tax at all. As a Shopify merchant, knowing the sales tax rate for each state where you have a nexus is important.

- Local Sales Tax: Cities, counties, and municipalities may impose additional sales taxes on top of the state rate. These local taxes can create a complex landscape where tax rates vary by state and city or county within a state. Local taxes are typically collected along with state taxes, and it’s crucial to ensure that your Shopify settings account for these variations.

- Use Tax: Similar to sales tax, use tax applies to goods and services purchased outside a state for use within that state, where sales tax was not collected. If you sell products to customers in a state where you don’t collect sales tax, those customers may still be responsible for paying use tax. While the responsibility for remitting use tax generally falls on the buyer, some states have enacted laws requiring out-of-state sellers to collect use tax under certain conditions.

Tax Thresholds

Each state may have different tax thresholds, which are minimum sales amounts or transaction volumes that require you to collect sales tax in that state. For example, if you exceed a certain number of sales transactions or revenue within a state, you may be required to collect sales tax there, even if you don’t have a physical presence.

Tax Rates

Tax rates vary by state and sometimes even by locality within a state. It’s important to stay updated on the tax rates that apply to your business, as they can change frequently. Shopify allows you to set up tax rates based on the state and locality to ensure you’re charging the correct sales tax amount.

Tax Exemptions

Certain products and services may be exempt from sales tax. For example, many states exempt groceries, prescription medications, and certain types of clothing from sales tax. Knowing the tax status of the products you sell and configuring your Shopify settings accordingly is essential.

Tax Registration

If you have nexus in a state, you’ll need to register with that state’s tax authority before you can start collecting sales tax. This process involves obtaining a sales tax permit, which authorizes you to collect and remit sales tax on behalf of the state.

Also Read:- Shopify Capital: An Ultimate Review

What Do Sales Tax Requirements Need to Check?

When determining your sales tax obligations, you need to check the following key factors:

- Sales are made to a customer in that state: If your customer is located in a state where you have nexus, you are required to collect sales tax on the sale.

- You have sales tax nexus in that state: As discussed earlier, nexus is the connection that triggers your obligation to collect sales tax. This could be due to physical presence, such as a warehouse or office, or economic presence, such as a certain sales volume.

- Your product is taxable in that state: Not all products and services are subject to sales tax. Understanding the taxability of your offerings in each state where you have nexus is crucial.

How to Set Up Shopify Sales Tax Collection?

Setting up sales tax collection in Shopify involves a series of steps to ensure compliance with state and local tax regulations. Follow these steps to configure your Shopify store correctly:

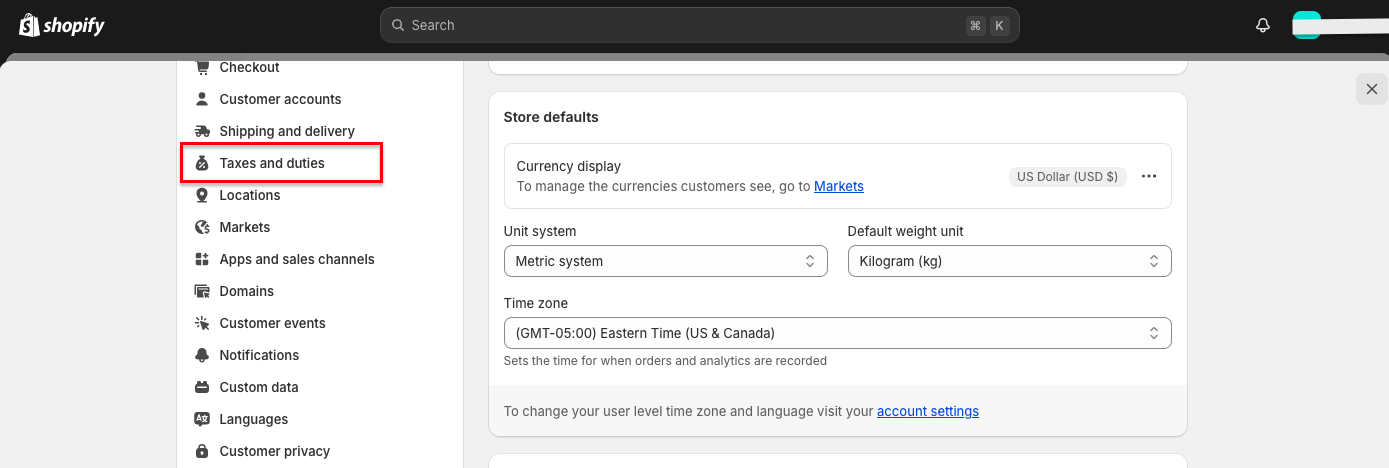

Step 1: Access tax Settings

- In your Shopify admin, go to “Settings and then select “Taxes and duties”.

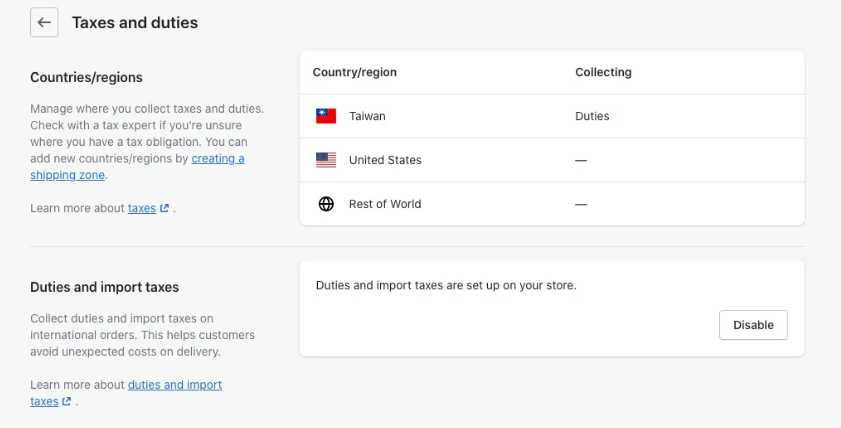

Step 2: Choose tax region

- Under “Tax regions,” click on your country.

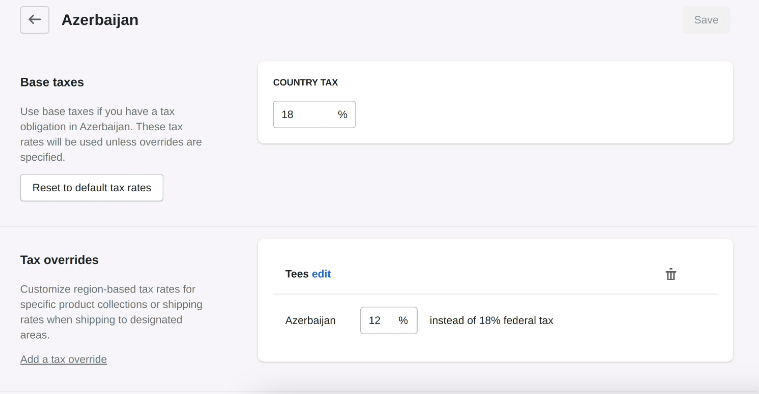

Step 3: Set up Base Taxes

- In the “Base Taxes” section, input the appropriate rates for your country and region. You can decide if a regional tax should be replaced, added to, or compounded with a federal tax.

Step 4: Save Your Settings

- Click on the “Save” to confirm your tax setup.

For registration-based taxes, you’ll need to provide a tax registration number from your local tax authority to calculate taxes. When you update your settings with this number, the tax rates for the regions where you’re registered will automatically adjust. This applies to countries like the United States, Canada, the European Union, the United Kingdom, Norway, Switzerland, Australia, New Zealand, and Singapore.

Step 5: Review and Test Your Tax Setup

After configuring your tax settings, place a few test orders to ensure that sales tax is being calculated and applied correctly. Check invoices and reports to verify that everything aligns with your expectations.

Following these sequential steps will ensure that your Shopify store is set up to collect the correct sales tax amount, helping you stay compliant with state and local regulations.

Shopify Built-In Tax Tool

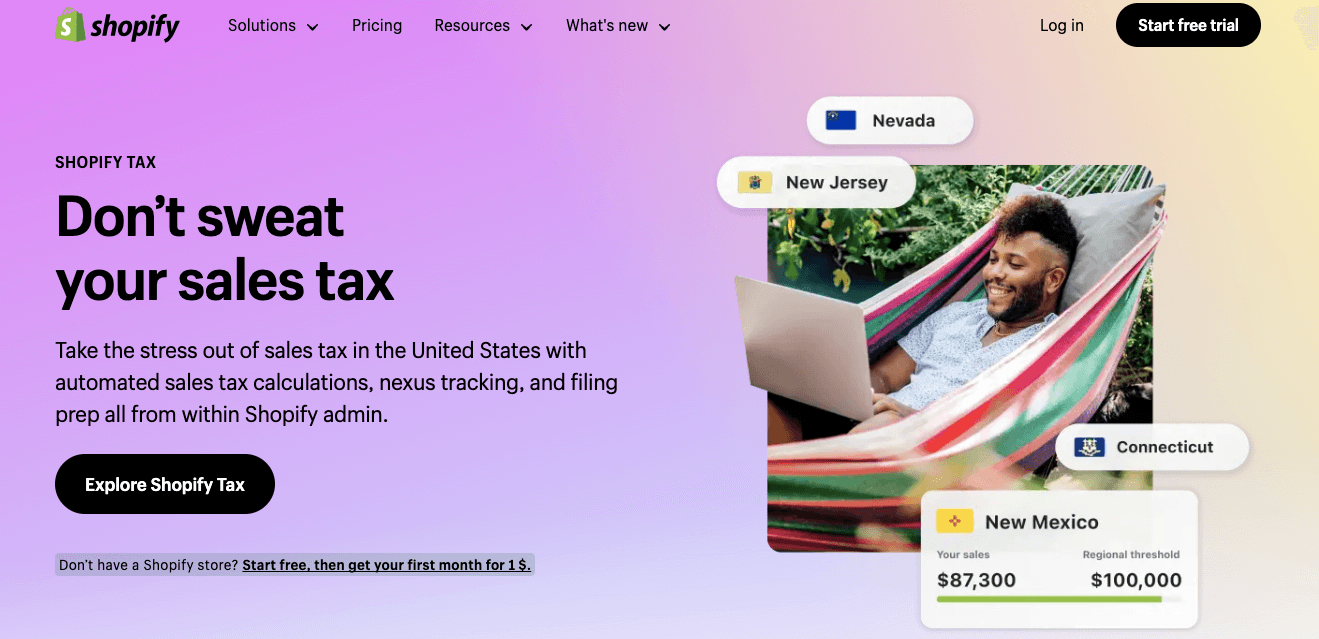

Shopify Tax is a robust paid solution designed to streamline sales tax management for eCommerce businesses. Integrated directly into the Shopify platform, this tool assists merchants in navigating the complexities of sales tax compliance across various regions.

Shopify Tax is a robust paid solution designed to streamline sales tax management for eCommerce businesses. Integrated directly into the Shopify platform, this tool assists merchants in navigating the complexities of sales tax compliance across various regions.

By automating numerous aspects of tax calculation and reporting, Shopify Tax helps to ease the administrative load on business owners, enabling them to focus more on business growth rather than tax details.

Key features include:

- Automatic Tax Calculations: Precisely calculates sales tax based on product type and customer location.

- Multi-Jurisdiction Compliance: Supports tax regulations across different states and countries.

- Real-Time Tax Rate Updates: Ensures that tax rates are always up to date with the latest laws.

- Product-Specific Tax Rules: Applies the correct tax rates for various product categories.

- Tax Reporting Tools: Provides detailed reports to aid in tax filing.

- Integration with Shopify POS: Maintains consistent tax application for both online and in-person sales.

- Tax Exemption Management: Simplifies handling of tax-exempt customers and transactions.

- International Tax Support: Facilitates VAT and GST calculations for global transactions.

- User-Friendly Interface: Makes tax setup and management straightforward within Shopify.

- Scalability: Adapts to your growing business, supporting tax compliance as you expand into new markets.

Tax Reports Documents Available on Shopify?

Shopify provides several reports to help you manage your sales tax obligations. These reports offer valuable insights into your sales tax collections and can assist with filing your tax returns.

1. Tax Finance Report

The Tax Finance Report provides a detailed breakdown of the sales tax you’ve collected. This report is essential for tracking your sales tax obligations and ensuring you’re remitting the correct amounts to the appropriate tax authorities.

2. Sales Finance Report

The Sales Finance Report offers an overview of your sales, including the sales tax collected on each transaction. This report will help you analyze your overall sales performance and understand your sales tax liabilities.

3. Premium Report – US Sales Tax Report

The Premium Report: US Sales Tax Report is a more detailed report that provides insights specifically into your US sales tax collections. This report is particularly valuable for merchants who sell across multiple states, as it helps you track your tax obligations in each state.

Shopify Sales Tax- FAQs

1. Do you pay sales tax on Shopify?

Yes, as a Shopify merchant, you are responsible for collecting and remitting sales tax in states with nexus. Shopify provides tools to help you automate this process, but it’s up to you to ensure compliance with state and local tax laws. Failing to do so can result in penalties, interest charges, and potential audits from tax authorities.

2. Does Shopify send sales tax to IRS?

No, Shopify does not send sales tax to the IRS. Sales tax is a state-level tax, and it’s your responsibility to remit the collected sales tax to the appropriate state or local tax authorities. The IRS deals with federal taxes, such as income tax, and is not involved in collecting or remitting state sales taxes.

3. Why is Shopify not charging taxes?

If Shopify is not charging taxes on your orders, it may be because your tax settings are not configured correctly. Make sure you’ve specified the states where you have nexus, categorized your products correctly, and checked that your shipping settings are set up to collect sales tax. Additionally, ensure that the customer or product is not marked as tax-exempt if it shouldn’t be.

4. Why is tax not showing on a Shopify invoice?

If tax is not showing on a Shopify invoice, it could be due to several reasons, such as the customer being in a state where you don’t have nexus, the product being tax-exempt, or an error in your tax settings. Review your tax configuration to ensure that taxes are applied correctly.

Final Thoughts

Understanding Shopify sales tax is crucial for any eCommerce business owner. This guide will better equip you to handle the complexities of sales tax compliance, ensuring you collect and remit the correct amounts while avoiding potential pitfalls.

As the eCommerce landscape changes, staying informed and proactive about your tax obligations will be critical to your long-term success. Remember, Shopify provides the tools to help you manage sales tax, but it’s up to you to use them effectively to keep your business on the right side of the law.