Sales receipts are an integral part of business transactions, providing crucial documentation and proof of purchase for both buyers and sellers. But what is a sales receipt? This question is fundamental to understanding the broader scope of business operations and financial management.

In this article, we’ll explore “what is a sales receipt?”, “why are receipts important?”, the information they typically contain, and much more. By the end, you’ll have a comprehensive understanding of sales receipts and their role in both daily transactions and overall business strategy.

What Is a Sales Receipt?

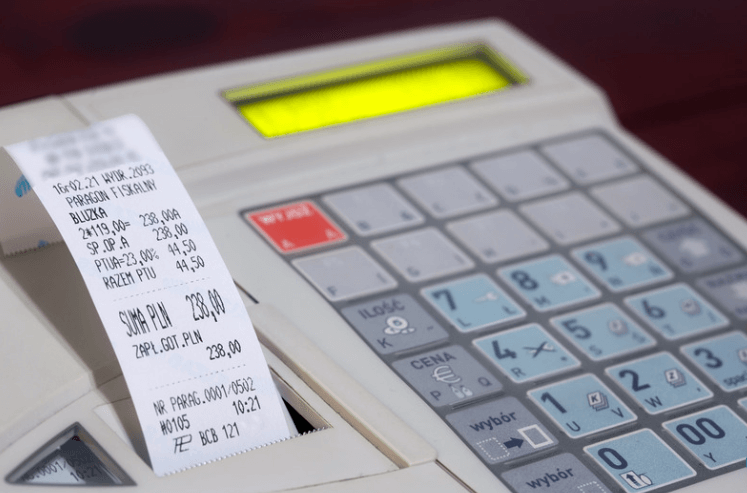

A sales receipt is a document issued at the point of sale to record a transaction between a seller and a buyer. It acts as proof of purchase for the buyer and offers a detailed record of the sale for the seller. Sales receipts can be issued in various forms, such as printed paper slips from a cash register or electronic receipts sent via email for online purchases. For online purchases, integrating receipts with email marketing platforms can help automate delivery and maintain a professional customer experience.

Sales receipts typically include crucial information such as the business name and address, the date and time of the transaction, a unique transaction number, a description of the items or services sold, and the total cost. This information is essential for both parties involved in the transaction. For businesses, sales receipts help maintain accurate financial records, manage inventory, and prepare for taxes. For customers, sales receipts are necessary for returns, exchanges, and warranty claims.

Understanding a sales receipt is fundamental for both business owners and consumers. For businesses, it ensures compliance with financial regulations and helps in maintaining organized records. For consumers, it provides a reference for their purchases and a means to handle returns or warranty claims. In both cases, a sales receipt is a critical document that supports the integrity and transparency of the transaction process.

Why Are Receipts Important?

Sales receipts play a vital role in business operations and customer transactions for several reasons:

- Accurate bookkeeping: Sales receipts provide a detailed record of each transaction, helping maintain accurate financial records. This data feeds into expense management software like Rippling, enabling businesses to monitor sales, control expenses, and evaluate overall financial health.

- Tax preparation: Receipts are indispensable during tax preparation, providing evidence of income and deductible expenses. They help ensure accurate tax filings and can protect businesses from penalties or audits by tax authorities.

- Legal purposes: In case of disputes or audits, sales receipts serve as legal proof of transactions. They protect both the buyer and the seller by providing a clear record of what was purchased, when, and for how much.

- Inventory management: Sales receipts help businesses track inventory levels by recording items sold. This information is vital for managing stock, planning reorders, and avoiding overstocking or stockouts.

- Customer service: Receipts are necessary for processing returns, exchanges, and warranty claims, enhancing customer satisfaction. A well-managed receipt system ensures customers can resolve issues efficiently and effectively.

- Business analysis: Analyzing sales receipts can provide insights into sales trends, customer preferences, and the effectiveness of marketing strategies. This data is invaluable for making informed business decisions and driving growth.

Information that Can Be Found on a Sales Receipt

A sales receipt is simply a record of a transaction provided at the time of purchase. This could be an email for online orders or a printed slip from a cash register. Typically, a basic sales receipt template includes the following elements:

- Business name and address: Identifies the seller and provides contact information.

- Transaction date and time: Indicates when the purchase was made, helping both parties track and verify the timing of the transaction.

- Transaction number: A unique identifier for the transaction, which is useful for reference in case of disputes or queries.

- Item or service sold: Describes what was purchased, including quantity and details that specify the product or service.

- Cost of item or service: Shows the price of each item or service, allowing customers to see a breakdown of their purchase.

- Total amount: The total cost of the transaction, including taxes and discounts, providing a final figure for the purchase.

- Payment method: Indicates how the payment was made (cash, credit card, etc.), which is useful for both record-keeping and financial reconciliation.

- Customer details: Sometimes includes the customer’s name and contact information, which can be useful for returns or customer service follow-ups.

- Return and exchange policy: Information on how to return or exchange items, helping customers understand their options and rights.

3 Types of Sales Receipts

There are various types of sales receipts, each serving a different purpose. The main types include:

1. Cash Register Receipts

These are printed by cash registers at the point of sale, typically in retail stores. They are the most common type of sales receipt and include all the necessary transaction details. Cash register receipts are usually generated automatically and are handed to the customer after the purchase.

2. Handwritten Receipts

Used when a cash register or printer is not available, handwritten receipts are manually written by the seller. They are common in small businesses or during offsite sales. While they may not be as polished as printed receipts, handwritten receipts still serve the essential function of documenting the transaction.

3. Packing Slips

These are included with shipped goods and list the items contained in the package. While primarily used for shipping purposes, they also serve as a receipt for the buyer upon delivery. Packing slips ensure that customers can verify their received items against their order, and they provide a reference in case of discrepancies or issues with the shipment.

What’s the Difference Between an Invoice and a Sales Receipt?

While both invoices and sales receipts are used in business transactions, they serve different purposes.

An invoice is sent before payment is made, requesting payment for goods or services. It includes payment terms and due dates. In contrast, a sales receipt is issued after payment has been made and serves as proof of purchase. It confirms that the transaction has been completed and paid for.

Besides, invoices are typically used in business-to-business transactions or in situations where goods and services are provided on credit. They include details about the payment terms, such as the due date and any penalties for late payment. Sales receipts, on the other hand, are used in transactions where payment is made immediately. They provide a record of what was purchased and are used primarily for bookkeeping, tax, and customer service purposes.

How to Make a Sales Receipt?

Creating a sales receipt involves several steps:

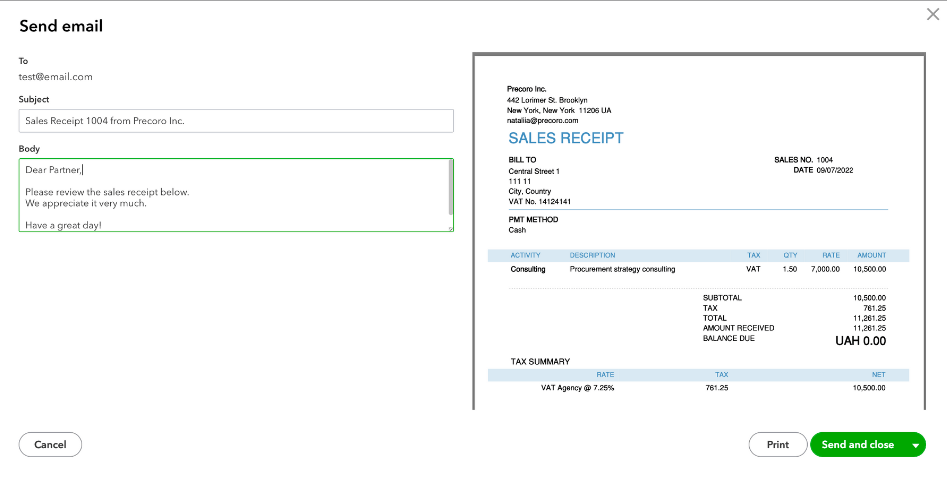

- Choose a template: Select a template that includes all necessary components, such as business name, transaction details, item descriptions, etc.

- Fill in business information: Include your business name, address, and contact details. This ensures that the receipt is easily identifiable and that customers can reach out if they have any questions or issues.

- Add transaction details: Record the date, time, transaction number, and payment method. This information is crucial for tracking and referencing the transaction.

- List items sold: Describe each item or service sold, including the quantity and cost. This provides a clear breakdown of the purchase and helps customers understand what they are being charged for.

- Calculate total: Add up the cost of items, including taxes and discounts, to get the total amount. Make sure all calculations are correct to prevent any discrepancies.

- Provide a copy: Give the receipt to the customer, either as a printed slip or an electronic document. Ensure that the receipt is clear and legible, and that it contains all necessary information.

Managing Sales Receipts for Your Small Business

Effective management of sales receipts is crucial for small businesses. Here are some tips:

- Organize receipts: Keep physical receipts in a designated place and organize electronic receipts in digital folders. This makes it easier to retrieve receipts when needed and ensures they are not lost. Consider using labeled folders and chronological sorting to keep everything in order.

- Using accounting software: Utilize accounting software to record and manage receipts, ensuring accurate financial records. Modern ai accounting software can automate receipt capture, categorize transactions, and reduce manual errors while saving valuable time. Popular options like QuickBooks, Xero, and FreshBooks offer robust receipt management features.

- Regular reconciliation: Regularly reconcile receipts with bank statements and accounting records to identify discrepancies. This practice helps ensure that all transactions are accurately recorded and can help identify any issues early on. Set aside time weekly or monthly for reconciliation to maintain accurate records.

- Retention policy: Establish a policy for how long to retain receipts, typically for at least three to seven years for tax purposes. Ensure this policy complies with local regulations and that all employees are aware of it. Properly stored receipts can be crucial during audits or legal disputes.

- Training staff: Train employees on the importance of issuing and managing receipts, ensuring consistency and accuracy. Well-trained staff can help ensure the receipt management process runs smoothly, contributing to the overall efficiency of your business operations. Provide regular training sessions and update staff on any changes in receipt management procedures.

Sales Receipts and Modern Business Tools

In today’s digital age, many businesses are transitioning to electronic sales receipts and utilizing advanced software to manage them. Here’s how modern tools can enhance sales receipt management:

- Electronic receipts: Many businesses now offer electronic receipts sent via email or SMS. These receipts are convenient for customers and environmentally friendly. They also make it easier for businesses to store and organize receipt records.

- Accounting software integration: Integrating sales receipt management with accounting software can streamline the entire process. These tools can automatically generate, send, and store receipts, reducing manual effort and the risk of errors. They can also provide real-time insights into sales data and financial performance. Using AI for accounting further enhances this integration by automating reconciliations, detecting anomalies, and delivering predictive insights that help businesses make smarter financial decisions.

- Mobile apps: Mobile apps for receipt management allow businesses to capture and store receipts on the go. This is especially helpful for businesses with multiple locations or sales representatives needing to issue receipts in the field. These apps can sync with your accounting software to maintain up-to-date records.

- Cloud storage: Using cloud storage for electronic receipts ensures they are securely stored and easily accessible from anywhere. This is particularly useful for businesses with several locations or remote employees. Cloud storage also provides a backup in case of data loss. To help businesses, top cloud cost optimization tools can track storage usage, eliminate wasteful spending, and ensure cloud-stored electronic receipts remain secure and cost-efficient.

What Is a Sales Receipt – FAQs

Understanding the nuances of sales receipts can raise various questions, particularly about their functionality, differences from other financial documents, and specific applications in business software. Here are some frequently asked questions regarding sales receipts:

What is a sales receipt?

A sales receipt is a document issued at the point of sale to record a transaction between a seller and a buyer. It serves as proof of purchase and provides a detailed record of the sale, including information such as the business name, transaction date, items sold, and total cost. It is an essential tool for accurate bookkeeping, tax preparation, and customer service.

What is the difference between an invoice and a sales receipt?

An invoice is a payment request sent out before the payment is made, commonly used in business-to-business dealings or for credit-based goods and services. It specifies payment terms and deadlines. Conversely, a sales receipt is given after payment is received, acting as proof of purchase and verifying the transaction’s completion.

What is a sales receipt on QuickBooks?

In QuickBooks, a sales receipt records a completed sale for which the customer has paid on the spot. It captures all the transaction details, including items sold, payment method, and total amount. QuickBooks automatically updates your financial records, helping you manage your sales and bookkeeping efficiently.

What is the difference between a billing statement and a sales invoice?

A billing statement summarizes all the transactions made within a specific period, providing an overview of what the customer owes. It is often used in ongoing business relationships where multiple transactions occur over time. A sales invoice, on the other hand, is a request for payment for specific goods or services provided and includes details about the payment terms.

In Conclusion

Understanding “what is a sales receipt” and its importance can significantly benefit both businesses and customers. Sales receipts are essential for accurate bookkeeping, tax preparation, legal protection, and inventory management. By effectively managing sales receipts, businesses can ensure smooth operations and compliance with financial regulations.